does idaho have inheritance tax

This number doubles for a married couple and becomes 2412 million. The Oregon Estate Tax.

How To Avoid The Idaho Gift Tax Step By Step

Even though Idaho does not collect an inheritance tax however you could end up paying.

. The Gem State has no estate or inheritance tax so unless your estate qualifies for the federal estate tax the exemption threshold is 1206 million for 2022 you don. Idaho does not have an estate or inheritance tax. No estate tax or inheritance tax.

Idaho does not currently impose an inheritance tax. No estate tax or inheritance tax. Inheritance laws from other states may apply to you though if a person who lived in a state with an inheritance tax leaves something to you.

Idaho residents do not need to worry about a state estate or inheritance tax. All Major Categories Covered. Maryland is the only state to impose both now that New Jersey has repealed its estate tax.

States That Have Repealed Their Estate Taxes. However like all other states it has its own inheritance laws including the ones that cover what. Call us toll free at 8772326101 or 2082326101 for a consultation with the Racine Olson team.

For more details on Idaho estate tax requirements for deaths before Jan. 1-800-959-1247 email protected 100 Fisher Ave. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

To fully understand the differences between these two types of taxes its important to first understand what each tax entails. Gifting away shares of your property to heirs presumptive you can protect up to 1206 million worth of heirdom. The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws.

No estate tax or inheritance tax. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Idaho has no state inheritance or estate tax.

Idaho is considered a tax friendly state. Our Idaho retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401k and IRA income. Seven states have repealed their estate taxes since 2010.

Idaho also does not have an inheritance tax. All of these debts must be paid off. How Long Does It Take to Get an Inheritance.

Idaho doesnt have an estate or inheritance tax for. The federal estate and gift tax exemption has been increased from 5000000 in 2017 to 10000000 in. In regards to an estate tax your estate is defined by the total of your debts and possessions that are left behind when you die.

952 White Plains NY 10606. Idaho does not currently impose an inheritance tax. Also gifts of 15000 and below do not require any tax payment or estate tax return.

Learn about Idaho tax rates for income property sales tax and more to estimate your 2021 taxes. 1 2005 contact us in the Boise area at 208 334-7660 or toll free at. Idaho does not levy an inheritance tax or an estate.

No estate tax or inheritance tax. The US does not impose an inheritance tax but it does impose a gift tax. Overall Idaho tax structure.

Delaware repealed its tax as of January 1 2018. Very few people now have to pay these taxes. Idaho Inheritance and Gift Tax.

It does not tax Social Security but it does tax. However like all other states it has its own inheritance laws including the ones that cover what. The gift tax exemption mirrors the estate tax exemption.

And although the Federal Gift Tax applies. Differences Between Inheritance and Estate Taxes. Section 15-2-102 permits a surviving spouse to inherit the decedents entire estate if the decedent did not have children and her parents are deceased.

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. According to the Oregon Department of Revenue the tax is called the Oregon Estate Transfer Tax. State estate taxes were abolished by legislative action on January 1 2010 in Kansas and Oklahoma.

This increases to 3 million in 2020 Mississippi. In Kentucky for instance the inheritance tax applies to all in-state property even for out-of-state inheritors. On the other hand you may owe an estate tax and the threshold of 1 million is relatively low.

Its essential to remember that if you inherit property from another state it may be subject to that states specific inheritance or estate tax. No estate tax or inheritance tax. If you live in Oregon you can be happy that you dont have to pay both an estate tax and inheritance tax like people in Maryland.

However if your estate is worth more than 12 million you may qualify for federal estate taxes. Also gifts of 15000 and below do not require any tax payment or estate tax return. The top inheritance tax rate is18 percent exemption threshold.

Idaho does not have an estate or inheritance tax. There is no federal inheritance tax but there is a federal estate tax. The top estate tax rate is 16 percent exemption threshold.

Heres a quick summary of the new gift estate and inheritance changes that came along in 2022. Idaho has no gift tax or inheritance tax and its estate tax expired in 2004. Estates and Taxes.

A decedents heirs are entitled to inherit her estate according to Idaho statute 15-2-101 when she dies without a will. Idaho has no gift tax and it is the most efficient and straightforward tool to reduce the taxable part of your estate. Select Popular Legal Forms Packages of Any Category.

Idaho Wills And Trust Requirements

Estate Tax Rates Forms For 2022 State By State Table

States With An Inheritance Tax Recently Updated For 2020 Jrc Insurance Group

How To Avoid The Idaho Gift Tax Step By Step

Taxes 1099 R Public Employee Retirement System Of Idaho

What You Need To Know About State Inheritance Estate Taxes Kdp Llp

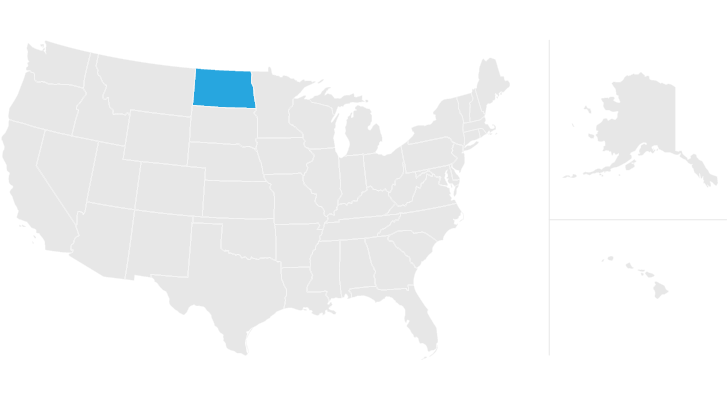

How To Create A Living Trust In North Dakota

4 Things You Need To Know About Inheritance And Estate Taxes

Don T Die In Nebraska How The County Inheritance Tax Works

Are Your Clients Subject To Massive Estate Taxes Without Knowing It Everplans

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Estate Tax Rates Forms For 2022 State By State Table

Estate Tax Rates Forms For 2022 State By State Table

Focus Shifts To State Estate Tax Planning Wsj

Where S My State Refund Track Your Refund In Every State

Betty White S Massive Estate Tax Bill And How Life Insurance Fixes It

Idaho Opportunity Zones Oz Funds Investing Id Tax Benefits

States With An Inheritance Tax Recently Updated For 2020 Jrc Insurance Group